| 索引号: | 所属主题: | 法律服务 | |

| 公开责任部门: | 中国贸促会原产地资讯 | 发文日期: | 2025-03-05 |

原产地判例与裁定阅读使用指引(上篇)

引 言

Introduction

在全球产业链高度交织与国际贸易政策日益复杂的背景下,美国对进口商品原产地的判断标准成为中国外向型企业面临的重要合规问题。特别是在《1974年贸易法》第301条款等特殊关税措施实施后,美国海关及边境保护局(CBP)对商品是否属于“中国原产”的裁定,直接影响企业的税收成本、清关效率以及全球供应链布局。

Against the backdrop of increasingly intertwined global supply chains and complex international trade policies, the U.S. standards for determining the country of origin of imported goods have become a key compliance challenge for Chinese export-oriented enterprises. In particular, under special tariff measures such as Section 301 of the Trade Act of 1974, the U.S. Customs and Border Protection (CBP)’s rulings on whether goods are of “Chinese origin” directly affect businesses’ tariff liabilities, customs clearance efficiency, and global supply chain strategies.

CBP的原产地裁定(Origin Ruling)制度,属于美方海关执法体系下的重要组成部分。企业或代理人可依据19 CFR §177提出裁定申请,CBP将结合产品材料来源、生产流程、核心功能判断等要素作出法律结论,明确商品原产地。虽然该类裁定仅对申请人具有法律约束力,但在实务中广泛被企业、律师、政府机构用作合规参考,尤其在风险预警和税收筹划方面具有重要价值。

The CBP’s origin ruling mechanism is a critical component of its enforcement framework. Enterprises or their representatives may submit a ruling request under 19 CFR §177, and the CBP will issue a legal conclusion on the product’s origin based on factors such as material sources, production processes, and core functional determination. Although such rulings are legally binding only for the applicant, they are widely used in practice by businesses, legal professionals, and government agencies as important references for compliance—especially in risk prevention and tariff planning.

To support Chinese enterprises in systematically understanding and effectively utilizing the CBP origin ruling system, the China Council for the Promotion of International Trade (CCPIT) has organized a special research initiative regarding U.S. Rules of Origin. This “Reading and Applica-tion Guide” serves as one of the key outputs of the study and focuses on the following core aspects:

• CBP原产地裁定的法律框架与制度逻辑

• 判定标准中的“实质性改变”含义解析

• 如何识别裁定文件结构与关键信息

• 常见产业(如电池、电子、服装等)的裁定案例

• 企业如何规避原产地风险、提升合规能力

• The legal framework and institutional logic of CBP origin rulings

• Interpretation of “substantial transformation” as the core standard

• How to identify key elements and structures in CBP rulings

•Industry-specific case studies (e.g., batteries, electronics, textiles)

•How enterprises can mitigate origin-related risks and enhance compliance

本指引适用于进出口企业合规负责人、法律顾问、行业协会以及政府外贸管理人员等,亦可作为境外布局规划、应对贸易摩擦和原产地合规培训的工具资料使用。

This guide is intended for compliance managers of import-export enterprises, legal advisors, industry associations, and government officials engaged in foreign trade administration. It can also serve as a practical tool in overseas production planning, trade friction response, and origin compliance training.

01美国原产地裁定制度简介

Legal Basis of the System

CBP原产地裁定的基础法律包括(适用“原产地请求”及“原产地标记请求”):

•《1930年关税法》第177条及其实施细则(19 CFR §177);

•《美国联邦法规》第19编第102章(19 CFR §102);

•《美国原产地规则合规指南》ICP U.S. Rules of Origin(EO13891-OT-112)中涉及的美国非优惠及优惠原产地规则体系中的实体性标准(参考CBP官方网址 https://www.cbp.gov/document/publications/rules-origin)

•《美国法典》第19卷第1304条及《美国联邦法规》第19编第134章(适用于原产地标记);

•《1974年贸易法》及其第301条款(适用于贸易制裁);

• 美国联邦法院与海关法院相关判例(如 Energizer Battery v. United States,National Hand Tool)

The legal basis for CBP country of origin determinations is primarily based on the following laws and regulations (applicable to Origin Rulings and Country of Origin Marking Rulings):

• Section 177 of the Tariff Act of 1930 and its implementing regulation (19 CFR §177);

• Title 19, Part 102 of the Code of Federal Regulations (19 CFR § 102);

• Substantive standards within the U.S. non-preferential and preferential rules of origin systems, as outlined in the U.S. Rules of Origin Compliance Guide ICP [EO13891-OT-112] (See CBP official website: https://www.cbp.gov/document/publications/rules-origin);

Section 1304 of Title 19, United States Code (19 U.S.C. § 1304) and Title 19, Part 134 of the Code of Federal Regulations (19 CFR § 134) (applicable to country of origin marking);

• The Trade Act of 1974, especially Section 301 (applicable in trade remedy actions);

• Relevant case law from U.S. Federal and Customs Courts (e.g., Energizer Battery v. United States, National Hand Tool).

CBP依据上述法律,在进出口环节判断商品的原产地,决定其是否属于某一国货物,以适用相应的普通关税、惩罚性关税或行政措施。

Based on these legal foundations, CBP determines the origin of goods at the time of import or export to decide whether they are considered products of a certain country for the purposes of regular duties, punitive tariffs, or administrative actions.

Application and Legal Effect of Origin Rulings

企业或其代理律师可依据19 CFR §177向CBP提出原产地裁定申请(Origin Ruling Request)。裁定由CBP下属《贸易与法规执行办公室》(Office of Trade, Regulations and Rulings)审理并书面出具。

An enterprise or its legal representative may submit an origin ruling request to CBP under 19 CFR §177. These rulings are reviewed and issued in writing by CBP’s Office of Trade, Regulations and Rulings.

裁定的特点如下:

Key characteristics of origin rulings include:

Relationship with Other Ruling Systems

CBP除原产地裁定外,还设有如下裁定制度:

• 税则归类裁定(Classification Ruling):确认商品在HTSUS中的分类;

• 估价裁定(Valuation Ruling):明确货值确定方式;

• 标记裁定(Marking Ruling):规定原产国标签方式;

In addition to origin rulings, CBP also administers the following types of rulings:

• Classification Rulings – to determine tariff classification under the HTSUS;

• Valuation Rulings – to clarify customs valuation methods;

• Marking Rulings – to specify country-of-origin marking requirements;

上述裁定制度可在同一申请中合并提出,但原产地裁定特别适用于判断可否适用如301条款等特殊税收政策。

These rulings may be combined in a single request, but origin rulings are particularly relevant when determining applicability of special measures like Section 301 tariffs.

Practical Value in Trade Operations

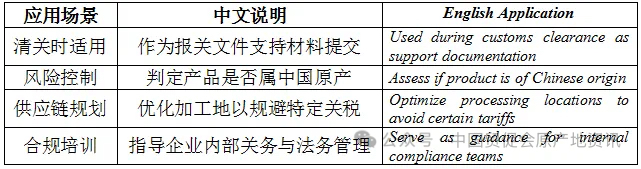

在实务中,CBP原产地裁定具备以下典型用途:

In practice,CBP's Origin Ruling could be applied in circumstances listed below:

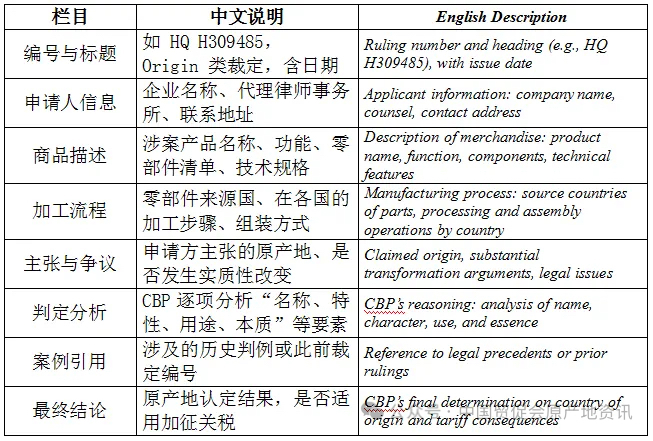

美国海关与边境保护局(CBP)出具的原产地裁定文件结构清晰,格式标准,适合企业、律师及管理部门快速理解和使用。一般而言,一份完整的裁定包括以下主要部分:

CBP origin rulings are issued in a standardized, structured format that allows enterprises, legal professionals, and regulators to easily interpret and apply them. A typical origin ruling consists of the following key components:

Basic Components of a Ruling Document

Tips for Identifying Key Information

在实际阅读中,以下位置通常包含关键判断信息:

• RE 段落:开头的“RE:”字段通常浓缩裁定请求核心问题;

• 争议描述部分:说明争议的原产地主张、申请方逻辑;

• CBP分析段落:包含最重要的法律判断逻辑,是理解裁定的关键;

• 最后结论段:明确表示 CBP 的判定结果与适用税号/附加税条款。

In practice, the following sections typically contain essential insights:

• RE Line: The“RE:” field at the beginning concisely summarizes the subject of the ruling request;

• Dispute Description: Outlines the origin claims and reasoning by the applicant;

• CBP Legal Analysis: Contains the core legal reasoning, essential for understanding the ruling;

• Final Determination: Clearly states the CBP’s decision and applicable tariff classifications or measures.

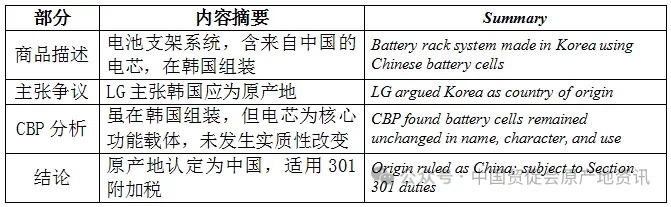

Example Structure: HQ H309485

以2020年CBP对LG化学“电池支架系统”的裁定为例,其结构如下:

Using CBP’s 2020 ruling on LG Chem’s “Battery Rack System” (HQ H309485) as an example, its structure has been illustrated as follows: